How to choose Mobile Hairdressing Insurance + top picks 2025

Disclosure: Glam Startups may earn commission from some of the links in this post at no extra cost to you. Glam Startups is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for the site to earn advertising fees by linking to Amazon.com and affiliated websites. Full details on our Affiliate disclosure page.

A mobile hairdresser may wonder if insurance is necessary. As a small business, you probably don’t have many assets, so what could go wrong?

Unlike large companies, smaller businesses can less absorb unexpected costs since there’s so much that can go wrong, making insurance essential for small businesses.

Mobile hairdressing insurance is a great way to protect yourself against the unexpected, but there are a few things you should consider before buying it.

Our top picks for 2025

PolicyBeePolicyBee offers specialized hairdressing insurance with a detailed quote generation process. You must have done a CPD-accredited course with face-to-face training to be insured by PolicyBee. |

||

Protectivity InsuranceMobile hairdressing insurance from Protectivity starts at £3.76/month. Covers include Public Liability, Employers’ Liability, Equipment, and Personal Accident.. |

||

HiscoxHiscox’s mobile hairdressing insurance stands out for its comprehensive coverage and level of detail |

Average hairdressing insurance: what is included?

Mobile hairdressing insurance can cover many areas. Below are some covers that most insurance companies typically provide.

Public Liability

Every mobile hairdresser should have public liability insurance. It provides coverage for injury or damage to a third party or their property, such as allergic reactions to clients, burns, or stains from hair dyes.

Your Public Liability policy will cover you if you are blamed for an incident like the one above, including the associated legal expenses of defending your case in court.

Legal cases can be costly when the risks are high. Your mobile hairdressing business will be at risk if you do not have public liability insurance.

Equipment Cover

This covers accidental equipment damage, loss, or theft. Most Insurance companies would cover equipment belonging to you or your employees for work-related damage to property, injuries, and sickness.

Employers’ Liability

Employers’ Liability insurance is a legal requirement if you hire employees and typically covers your liability to employees

Personal Accident Cover

Personal accident cover is insurance that protects the policyholder in the event of an accident. The insurance company will pay for medical expenses for issues such as loss of hearing &sight or even death.

Some business insurance companies, such as Superscript, also cover accidents that leave professionals or their employees disabled or permanently unable to work.

Cyber Insurance

This cover protects against various cyber risks and covers the cost of damage to, loss, or destruction of information and other tangible property.

Cyber attacks can happen in different ways, such as through data breaches or security failures.

Hairdressing businesses and salons are potential targets for cybercriminals since they collect, store and process sensitive information from their clients; hence it is essential to consider cyber protection if your mobile hairdressing business has websites or electronic records. If a hacker locks your website and demands a ransom, what will become of your business if you now use an online booking system?

How much does mobile hairdresser insurance cost?

It can be difficult to estimate the cost of business insurance for mobile hairdressers and beauty technicians who are always on the move, but you can tailor it to your needs, so there’s no ‘one size fits all’ premium amount.

Where do I start looking for mobile hairdresser insurance?

Looking for insurance can be both confusing and annoying. It can be challenging to choose from the myriad options offered to businesses today.

Hairdressing insurance in the UK is available in many places, so it’s best to start by finding a website that lets you compare a few quotes with little hassle. Here are a few companies that offer insurance covers for mobile hairdressers.

Superscript (Only available in the UK and Netherlands)

Superscript offers a range of covers to Mobile hairdressers and other beauty professionals, including Beauty therapists and barbers.

This company offers 3 types of covers:

- An Essential cover (starting at £5 per month) for businesses that need protection against injury or damage/loss of property.

- A Professional cover (starting at £7.58 per month) protects beauty professionals against risks associated with their services or marketing.

- A Management cover (starting at £6.90 per month) protects business owners and their shareholders against operational risks.

PolicyBee (Available in the UK)

PolicyBee also offers covers specifically meant for hairdressers. What makes this company different is the level of information they provide during the quote generation process. You must have done a CPD-accredited course with face-to-face training to be insured by PolicyBee.

PolicyBee’s covers include public and employer’s liability, Treatment liability, Property and cyber insurance.

Hiscox

(Available in the UK, Belgium, Bermuda, France, Germany, Ireland, Netherlands, Spain & Portugal)

Hiscox also offers mobile hairdressing insurance, which makes this offer interesting is their level of detail and the number of covers.

Besides the standard covers such as professional treatment & public liability insurance, employers liability insurance, cyber insurance, personal accident insurance and legal protection insurance, Hiscox also offers portable equipment insurance.

As a mobile hairdresser- moving a client’s house to another- portable equipment insurance cover protects your hairdressing kit against damage or loss.

Hiscox only provides estimates for their covers during the quote generation process.

When writing this article, we generated a quote for general liability, professional liability and cyber cover, which generated a quote of $58/ month. For the cover, Hiscox guaranteed a general liability occurrence limit of $1,000,000 and a cyber insurance occurrence limit of $1,000,000, which are more than enough for a mobile hairdresser.

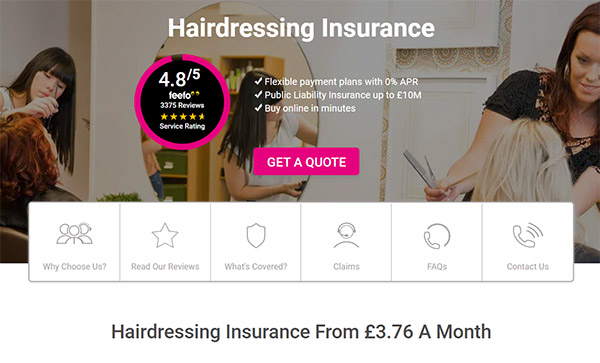

Protectivity (UK)

Protectivity offers mobile hairdressing insurance for as low as £3.76 a month and provides several covers, including Public Liability, Employers’ Liability, Equipment Cover and personal accident cover. This company also offers detailed information specifically meant for mobile hairdressers (Similar to PolicyBee). Still, it provides a detailed FAQ (frequently asked questions) that we thought helpful.

An important thing to note is that although Protectivity does not request mobile hairdressers to provide hairdressing qualifications, they may require you to have qualifications for some services not listed on their website.

Protectivity’s knowledge and focus on mobile hairdressing, price transparency and affordable packages make it interesting.

Beauty- specific Insurance Companies (UK)

One of the frequently asked questions is whether there are companies that only focus on providing insurance to hairdressers. Salon Gold and Salon Saver do just that.

Other companies such as Beauty Guild and The National Hair & Beauty Federation (NHBF) provide both insurance, professional memberships and online courses, which can be beneficial for mobile hairdressers interested in ‘extras’ such as networking opportunities.

For instance, some of the membership benefits offered by The National Hair & Beauty Federation (NHBF) include 24/7 tax, VAT, payroll and GDPR support, a free health and safety helpline, business coaching and more.

Are you a mobile hairdresser or freelance beauty tech looking for any other type of Insurance? We have a few detailed reviews and interviews coming up soon. Be sure to sign up for updates – you will be notified as soon as we publish them.

Frequently asked questions

Why do I need mobile hairdressing insurance?

As a mobile hairdresser, you are exposed to unique risks that come with running a business on the go. Mobile hairdressing insurance can protect you from liabilities such as accidental damage to a client’s property, personal injury claims, and other unexpected incidents that could result in financial losses.

What types of mobile hairdressing insurance are available?

Several mobile hairdressing insurance policies are available, including public liability insurance, professional indemnity insurance, and business equipment insurance. You may consider combining these policies to ensure comprehensive coverage depending on your specific needs.

How much does mobile hairdressing insurance cost?

The cost of mobile hairdressing insurance will depend on various factors, such as the level of coverage you require, the size of your business, and your claims history. Shopping around and comparing policies to find one that fits your budget while providing adequate coverage is essential.

Do I need to have a license to get mobile hairdressing insurance?

While having a license is not a requirement for getting mobile hairdressing insurance, it can help you secure better coverage and lower rates. Many insurance providers require proof of professional qualifications and may ask for evidence of training and experience before issuing a policy.

How can I choose the best mobile hairdressing insurance policy for my business?

To choose the best mobile hairdressing insurance policy, it’s important to assess your business needs, understand the different types of coverage available, and compare policies from different providers. It may also be helpful to seek the advice of a licensed insurance broker who can guide you through the process and help you find the right policy for your business.